The Dictatorship

McDonald’s is clowning itself with its DEI rollback

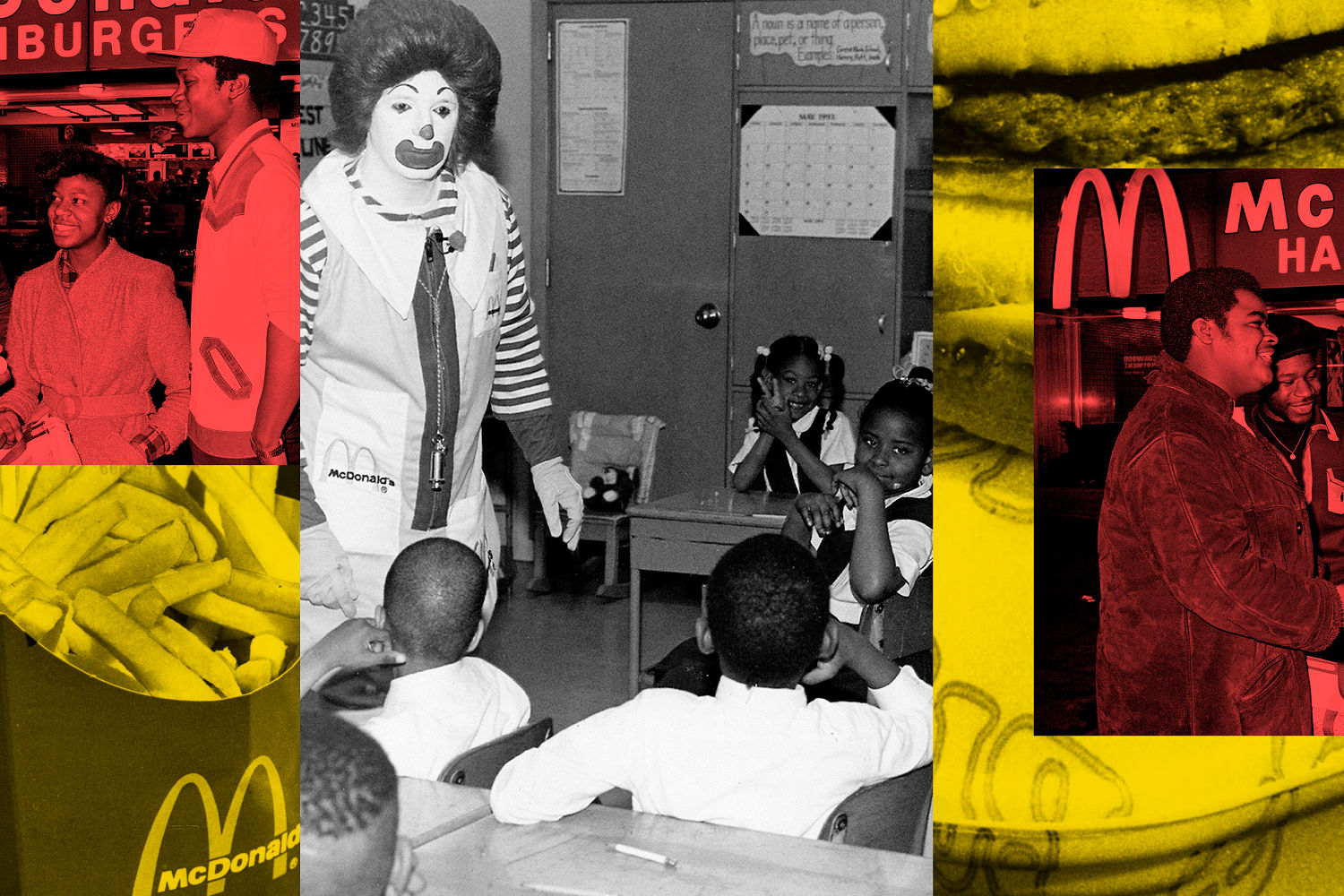

During the height of the racial justice protests that came after Minneapolis police murdered George Floyd, McDonald’s joined the fray of businesses and institutions declaring their solidarity with all those committed to ending racism. In a post on June 3, 2020on the platform then known as Twitter, McDonald’s shared a short video listing Floyd’s name alongside other Black victims of violence, including Trayvon Martin and Atatiana Jefferson.

McDonald’s announced this week that it’s stepping away from its previously established DEI goals.

In muted red and yellow tones, the video read: “He was one of us; she was one us,” and continued that the “entire McDonald’s family grieves.” McDonald’s declared itself in solidarity with “victims of systemic oppression,” and made it clear that the corporation stands “with Black communities.” It offered as proof its donations to the Urban League and the NAACP. The video ended with a black screen with white letters: “Black lives matter.”

It’s unlikely that McDonald’s will be posting a similar video anytime soon. McDonald’s announced this week that it’s stepping away from some of its previously established DEI goalsretiring a specific DEI pledge and changing the way it refers to its diversity team.

The gestures made during the summer of 2020 appear to have been compelled more by peer pressure than by principle. Now, leaders of organizations from big-box stores to universities have publicly disavowed policies promoting diversity, equity and inclusion, whose acronym DEI has become shorthand for any and all attempts to address centuries of homogeneity, inequality and exclusion in educational and professional spaces.

In other sectors, leadership and development support programs for racial and ethnic minorities have been renamed, restructured or simply retired. And in light of the Supreme Court curtailing affirmative action in higher education and a concerted conservative onslaught on diversity, equity and inclusion efforts, McDonald’s frames its move as an attempt to pre-empt further court challenges to its diversity efforts.

In a Jan. 6 open letter to employees and franchisees that acknowledges “the shifting legal landscape,” the company’s senior leadership team announced what it called “a new concept: the power of OUR ‘Golden Rule’ — treating everyone with dignity, fairness and respect, always.” The company says it is:

- “retiring setting aspirational representation goals and instead keeping our focus on continuing to embed inclusion practices that grow our business into our everyday process and operations”

- “pausing external surveys to focus on the work we are doing internally to grow the business”

- “retiring Supply Chain’s Mutual Commitment to DEI pledge in favor of a more integrated discussion with suppliers about inclusion”

- and “evolving how we refer to our diversity team, which will now be the Global Inclusion Team.”

McDonald’s senior leadership said it remains committed to inclusion and believes a diverse workforce is a competitive advantage.

How it distributes its supply contracts not only impacts which companies get the opportunity to stock McDonald’s restaurants with hamburger buns and sausage patties, but it also impacts workers who prepare these essential goods. “Pausing external surveys” means aggrieved employees may have trouble collecting data and information on potentially discriminatory action within the organization.

McDonald’s is among a few corporations that have profited heartily from the idea that they are a friend to Black communities. Long before the summer of 2020, the summer of 1968 (which followed the assassination of Martin Luther King Jr.) spurred soul-searching and reflection about how people in power could be vehicles for social change. Unfortunately, in both eras, many of the proposed solutions pivoted on businesses making commitments to recruit more talent of color while also eyeing the ways that these seemingly pro-social policies could also yield more profits.

McDonald’s has profited heartily from the idea that it is a friend to Black communities.

McDonald’s had already emerged as a dominant presence in the fast-food world, but in the late 1960s, the company would distinguish itself as leader in what would eventually be called DEI. The first step was recruiting its first Black franchisee, Herman Petty, to reopen a store on Chicago’s South Side in December 1968, and enlisting Black regional managers and advisers to build what would be called “Black stores.” A numerically modest but economically impactful group of Black franchise owners introduced and revived the brand among urban consumers of color. McDonald’s devoted an advertising budget to create content exclusively for minority media and recruited Black celebrities like Michael Jordan and Gladys Knight for national campaigns, making the company a leading source of contracts for Black-owned radio and TV networks, as well as marketing and consulting firms.

The McDonald’s logo appeared on material heralding contributions to civil rights organizations, historically Black colleges and universities and cultural initiatives. Many of those actions were initiated and funded by its growing network of Black franchise owners, who tried to hold McDonald’s accountable for contributing to a loyal and critical part of their consumer market.

Forty-four years after the first Black franchise owner entered the McDonald’s system, the chain selected Don Thompsonits first Black CEO, in 2012. That felt like a sign that the Golden Arches could recognize Black talent after decades of touting itself as a diversity champion in its recruitment efforts. Much of the company’s success — from the 1980s until the mid-2000s — was related to the work of Patricia Sowell Harrisa pioneer in the field of corporate diversity who started her early career at McDonald’s as an affirmative action officer in 1985.

In light of the national backlash against discussing the nation’s history or racism, it may not come as much of a surprise to those who don’t know the company’s history that McDonald’s is disavowing DEI. But so much of McDonald’s branding strategy for the last 50 years has promoted the chain as not just a place to eat cheap food served fast but as a supporter of the Black community and Black entrepreneurship.

This thinking and strategy expanded to other communities that gave birth to affinity groups for Latino franchisees, members of the AAPI community, women and LGBTQ people. This was smart business because it was lucrative, but it was also protective business because such demonstrations of appreciating diversity could also be used to deflect serious and important challenges to the labor experiences of its workers, most of whom are people of color.

So much of McDonald’s branding strategy has promoted the chain as a supporter of the Black community and Black entrepreneurship.

In recent years, when Black franchisees have organized and filed lawsuits against McDonald’s claiming racial discrimination related to the assignment of restaurants and alleging a lack support during challenging times such as the Covid-19 shutdowns, McDonald’s was able to argue its bona fides in creating Black wealth through franchises and its internal commitment to diversity.

But with its announcement that it’s retiring certain DEI policies, McDonald’s seems to have concluded that it doesn’t need the diversity talking points anymore, and although it’s one of the most powerful and influential global corporations with a record that speaks volumes about how diversity initiatives have enriched the company, it doesn’t appear to believe that diversity — no matter how superficial — is worth fighting for anymore.

In McDonald’s announcement, the company argued that its “early and full adoption of inclusion gives us a competitive advantage,” which both recognizes and glosses over the dynamic history that McDonald’s has had in DEI and signals that the company hopes the public will use the past to inform the present. But it’s still uncertain what the future will hold for a company that once touted itself to be a fast-food leader and has revealed that, like most corporations, it’s just a self-interested follower.

Marcia Chatelain

Marcia Chatelain is a professor of African American Studies at the University of Pennsylvania and the author of the Pulitzer Prize-winning book “Franchise: The Golden Arches in Black America.”

The Dictatorship

Greg Bovino was the hero of his own movie

With his heavily gelled buzz cut and his willingness to use violence against peaceful protestors, Border Patrol chief Gregory Bovinothe public face of President Donald Trump’s deportation spree and a so-called commander at large, seemed straight out of central casting. His aggressive tactics and flair for the dramatic made Bovino the perfect avatar for an immigration policy designed to prioritize spreading fear and pain over accuracy and efficiency.

Neither courtroom condemnations nor public backlash seemed to dampen his zeal for transforming the pain of immigrants caught up in federal sweeps into viral content. Bovino, whose career path was inspired by a 1980s Jack Nicholson movieseemed to relish the opportunity Trump’s deportation ramp-up gave him to play the main character.

Bovino, whose career path was inspired by a 1980s Jack Nicholson movie, seemed to relish the opportunity Trump’s deportation ramp-up gave him to play the main character.

When a federal officer shot and killed Renee Good in her SUV in Minneapolis this month, Bovino continued to encourage his agents’ confrontations with demonstrators and observers. Only when a Border Patrol agent under his command fired his gun into Alex Pretti was Bovino hustled out of Minnesota and back to his base in southern California.

Bovino being sent away was a begrudging acknowledgment from the Trump administration that it’s losing the public relations war. But it’s inaccurate to say he was “demoted” from the role as “commander at large” because that position doesn’t officially exist. More importantly, it’s likely that the forces he marshaled in the field will march on without him.

Bovino’s visibility increased exponentially after the White House became frustrated that Immigration and Customs Enforcement, which has traditionally run targeted operations to detain individuals and not indiscriminate dragnets, wasn’t even getting halfway to deputy chief of staff Stephen Miller’s goal for 3,000 arrests per day.

As ICE fell in standing, Border Patrol rose in its place. The Atlantic’s Nick Miroff pointed out last year that “Trump’s militarized border crackdown and ban on asylum seekers have reduced illegal crossings to the lowest levels since the 1960s, leaving Border Patrol agents with more time on their hands.” That extra time has been spent acting as added muscle during immigration raids, leading them to be as visible as ICE — if not more so — during Trump’s deportation campaign.

And there at the forefront was Bovino, who joined CBP in 1996 and rose through the ranks to become chief of the patrol’s El Centro sector. When he was a child, Bovino told The New York Times that his parents took him to see “The Border,” starring Nicholson and Harvey Keitel. The film and the books he later consumed painted a picture of “a pretty tough organization to be out there alone with no backup,” he told the Times. “And I began to realize that that thing called the US Border Patrol is probably something pretty special.”

The corruption and lack of morality on display from most of the officers in “The Border” appear not to have bothered him. He instead seemed to internalize the idea that an agent needs to subvert bureaucracy and act on instinct against the evildoers of the world, a view that doesn’t translate into effective law enforcement.

Upon becoming sector chief in 2020, The Atlantic reportedBovino harnessed his love of the dramatic and “became the lead auteur of a new style of highly produced videos for CBP.” According to an April 2025 report by the nonprofit newsroom CalMatterslast year, Bovino’s El Centro sector employed “five Border Patrol agents whose job it is to produce videos.”

Bovine”https://www.thetimes.com/us/american-politics/article/who-is-gregory-bovino-coat-border-patrol-j29xxmzmj?gaa_at=eafs&gaa_n=AWEtsqfNbwp9REBepWQAGSE-V1yzJzVRHepKOAiYfl1EgeJSBt5Xes5f9wN8oyGuRIU%3D&gaa_ts=697d4d81&gaa_sig=P2boAcJS1-_zAEy5wEf6pUXMUmujT6ewSfHWgyUYmJqrboSLnY5i6RHZnex4Ca95N61pGFMeBcVS7c0979ewdg%3D%3D”>reportedly bristled at policy shifts during the Biden administration that allowed an estimated 5.8 million migrants to either be granted parole or seek asylum between 2021 and 2024. In 2023, he briefly became the subject of a minor partisan firestorm when he was temporarily relieved of command and assigned a desk job in Washington. Bovino and congressional Republicans called it retaliation for his wanting to testify at a GOP-led hearing on President Joe Biden’s border policies. Or perhaps it had more to do with his social media footprintwhich included a profile picture of him in a black bulletproof vest brandishing an M4 assault rifle, looking every inch the image of a maverick willing to kick ass for his country.

The day after Trump’s win was certified last year, that is, still during the Biden administration, a team of Border Patrol agents traveled five hours north of El Centro to take part in a large-scale raid Bovino dubbed “Operation Return to Sender.” A federal judge later determined that the Kern County operation likely hinged on “stopping individuals without having a reasonable suspicion of illegal presence, as required by the Fourth Amendment.” CalMatters likewise reported: “Border Patrol officials misrepresented the very basics of their high-profile, large-scale immigration raid. Data obtained from U.S. Customs and Border Protection reveal that Border Patrol had no prior knowledge of criminal or immigration history for 77 of the 78 people arrested.”

When asked about “Operation Return to Sender,” which he carried out without approval from his superiors, Bovino was unrepentant. If his goal was to get the attention of the incoming administration, though, it worked like a charm. It’s unclear precisely when he came across the radar of Homeland Security Secretary Kristi Noem and Corey Lewandowskiher unofficial chief of staff, but she elevated Bovino to the head of the vanguard.

In a recently resurfaced video from June, after mass protests followed high-profile ICE raids in Los Angeles County, Bovino tells federal officers under his command: “Arrest as many people that touch you as you want to. Those are the general orders, all the way to the top.”

A subsequent ride through the city’s MacArthur Park on horseback as part of a show of force was met with anger and scorn from Angelenos. Bovino responded with a Kendrick Lamar-soundtracked hype video using footage of the operation. It was one of many such videos his office churned out from L.A. that framed Border Patrol and other law enforcement officials as action heroes battling chaos.

Los Angeles was the template for later deployments, sending Bovino traipsing across the country with overarching control of the stepped-up immigration operations. By late October, he had a new title to go along with his newly unfettered position. “Commander at large” is a role that doesn’t exist anywhere on paper, but it reportedly freed him from the chain of command and left him answerable only to Noem herself.

Bovino seemed to test that new authority in Chicago, where his willingness to escalate against protestors and his sworn testimony about his actions led to a sharp judicial rebuke. Video showed Bovino lobbing a canister of tear gas into a peaceful group of protesters, only for him to later claim that he did so in response to being hit with a rock.

During a deposition for a lawsuit that followed, Bovino acknowledged that he hadn’t been hit by a rock. During that same deposition, he declined to make any distinctions between lawful protesters and violent rioters. While imposing an injunction barring federal officers from using excessive force, U.S. District Court Judge Sara Ellis called Bovino’s “testimony not credible” and said in some of his testimony he was “outright lying.”

But as The Wall Street Journal reported in October, rather than leading Noem and Lewandowski to withdraw their support, Bovino’s tactics “earned plaudits from the pair, who have given him wide latitude to run his own operation.” By mid-November, he was spotted in North Carolina for the disgustingly titled “Operation Charlotte’s Web.” Quoting the classic children’s book, Bovino boasted, “We take to the breeze, we go as we please.” He proceeded to breeze back out of the state after only a week on the ground and roughly 450 arrestsa small amount given the magnitude of the disruption his agents caused.

His goal in New Orleans was 5,000 arrestsaccording to The Associated Press, but he was deployed to Minneapolis before he got anywhere near that goal.

He spent seven weeks on the ground in Minnesota, and not even an ICE officer killing Renee Good or Alex Pretti changed his tune. When BLN’s Dana Bash told Bovino that his remarks about Pretti “feel as though in some ways you’re blaming the victim here,” Bovino responded, “The victim? The victims are the Border Patrol agents.”

While his so-called turn and burn tactics won’t have his direct blessing, Border Patrol officers are still on the ground in Minneapolis

Two days later, Bovino was removed from his post and sent back to California. The role of “commander at large” now sits empty. His once frenetic social media feed has been quiet since Monday.

Jenn Budd, a former Border Patrol agent turned immigration activist, told The Times of London that in her research, Bovino popped up as “a little Napoleon who wants you to think that he is the most moral and capable guy in the world, and everything around you is dangerous but he’s the one who’s going to save you. It’s all a show for him.” Small wonder then that he was cast in the role he played so effectively for the Trump administration.

Meanwhile, Bovino’s removal from the field may have little immediate effect on how ongoing immigration operations play out. While his so-called turn and burn tactics won’t have his direct blessing, Border Patrol officers are still on the ground in Minneapolis. And there’s no reason to assume the violent raids and indiscriminate attacks on observers and demonstrators will end just because he’s gone.

Border Patrol has a mandatory retirement age of 57meaning Bovino doesn’t have long left as a member of the agency he’s idolized. When he finally hangs up his green uniform, whether that’s sooner or later, he’ll have a legacy that, for better or for worse, will endure.

Last year, the Trump administration overhauled ICE’s leadership to place current and retired Border Patrol officials in charge of field offices around the country. NBC News reported then that the changes were orchestrated by Le wandowski and Bovinowho worked together to draw up the list of ICE offices they believed were lagging.

When you boil down Bovino’s position as “commander at large,” it wasn’t about increasing the number of arrests; those are still far below Stephen Miller’s quotas. Nor was it about the number of dangerous individuals taken off the street, especially with an administration that falsely lumps together all undocumented immigrants as criminals. It was about content: Bovino’s specialty.

At the height of Operation Midway in Chicago, a massive force of more than 300 federal agents descended on an apartment building in the middle of the night. Agents rappelled down from a Black Hawk helicopter, dragging residents from their homes and into the streets. ProPublica reporting later showed that no federal criminal charges were filed against anyone arrested that night, nor were the government’s claims that the building was a hub of gang activity borne out. But the video the administration released of the raid had all the hallmarks of a leader whose inspiration to join Border Patrol was born at the movies.

Hayes Brown is a writer and editor for MS NOW Daily.

The Dictatorship

I watched the Melania Trump film so you don’t have to

With the release of “Melania,” a film so devoid of substance that it feels wrong to call it a documentary, we might need to come up with a new word for shameless. Because shameless doesn’t seem harsh enough to describe the grotesqueness of releasing this cinematic farce at the end of one of the most brutal months in recent American history.

“Melania” is a film so devoid of substance that it feels wrong to call it a documentary.

To be fair, when the release date was set, no one knew that the nation would be reeling from the fatal shootings of two Minnesota residents by Immigration and Customs Enforcement agents. Or how ICE agents would be terrorizing communities in Minneapolis and other U.S. cities. Or how heartbreaking images of Liam Ramosa 5-year-old Minneapolis boy snatched out of his driveway with his father, would blanket social media.

But that is the climate that greets “Melania,” a movie determined to inform audiences that first lady Melania Trump cares about nothing so much as the welfare of our children and the freedoms we hold dear as Americans. “No matter where we come from, we are bound by the same humanity,” she says in one of many platitude-filled voiceovers that are slathered across “Melania” like sugary icing on a cake baked with sugar, flour, eggs and heaping amounts of hypocrisy. “I will always use my influence and power to help those in need,” she insists in another.

Across some 104 minutes, the first lady delivers these blatantly scripted and meaningless narrations with all the conviction of someone who just woke up from a two-hour nap and can’t remember what day it is.

The details about this project raised a cascade of red flags well before it opened in multiplexes Friday. Amazon spent $40 million to acquire this behind-the-scenes study of Melania during the 20 days leading up to the 2025 inauguration, a move The New York Times recently characterized as a blatant attempt to curry favor with President Donald Trump. Amazon founder Jeff Bezos is even among the wealthy tech titans seen attending a pre-inauguration candlelight dinner hosted by Melania Trump. “Our donors were truly the driving force behind our campaign,” she narrates.

It is one of the few honest things she says in the whole film.

Whatever one may have expected from a cinematic study of Melania Trump, nothing could prepare audiences for how shallow this dive into Trump World really is.

“Melania” is directed by Brett Ratnerbest known for the decades-old “Rush Hour” franchise that President Trump recently pushed to reboot. In more recent years, Ratner has been accused of rape and sexual assault by multiple women (he denies the allegations) and his name surfaced in some of the Epstein files. Because apparently this vapid docu-endeavor didn’t already feel unsettling enough. (Also mentioned in the most recent release of Epstein files? Melania Trump.)

It appears that Ratner thought that just following Melania Trump around would provide a wealth of compelling cinematic material. Mission extremely not accomplished. Whatever one may have expected from a cinematic study of Melania Trump — Is she the power behind the throne? What is her relationship with her husband actually like? — nothing could prepare audiences for how shallow this dive into Trump World really is. I am not even talking about all the things it does in poor taste, including turning footage from Jimmy Carter’s funeral into a sequence about the death of Melania Trump’s mother a year prior. The film is poorly shot and edited, with Ratner repeatedly relying on the same imagery. The number of close-ups of Trump’s stilettos (sometimes heels, sometimes boots — she’s got range!) could break a cinematic record for the most unnecessary shots of a woman’s feet. (Yes, I am very familiar with Quentin Tarantino’s work.)

Whatever the truth of Melania the woman, “Melania” the work is incredibly boring.

Whatever the truth of Melania the woman, “Melania” the work is incredibly boring. Over and over again, viewers must watch Mrs. Trump get into and out of cars, walk long distances inside various buildings, and attend meetings where she and her coterie of stylists and designers discuss such weighty issues as her inaugural ensemble or the new decor for the White House.

The details are more than even the first lady’s most ardent fans could possibly care to know. To the many Americans struggling economically, watching Melania Trump reveal the golden-egg-shaped caviar she plans to serve at her pre-inaugural dinner will read as a truly Marie Antoinette moment. This thing is basically “Let Them Eat Cake: The Movie.”

But because this depiction is, above all, an exercise in brand management, there is footage of Melania doing Serious First Lady Work, such as talking about her Be Best initiative with Brigitte Macron, the first lady of France, or meeting with an Israeli woman who was held hostage by Hamas and is desperate to bring home her still-captive husband. (Title cards at the end that tout Melania Trump’s various accomplishments say that she helped get the man released after Trump took office.)

Even in interactions designed to make her seem kind, Trump seems stilted and uncomfortable. Ultimately, she remains a well-coiffed cypher. At no point do we get new insight into who she is because throughout the work, she glosses over her experiences without providing concrete or illuminating details. A film that’s supposed to allow her to reflect on her life is like watching someone try to write a book report about a book she didn’t read.

This thing is basically “Let Them Eat Cake: The Movie.”

Melania’s interactions with her husband, too, convey little that hasn’t already been observed. There is minimal warmth between them, and President Trump is equally mindless in his responses to questions. “There’s nobody like her,” he says when Ratner, off camera, asks the president to talk about his wife. “She’s really difficult. But there’s nobody like her.” The most relatable moment is when the president asks his wife if she watched the congressional certification of his votes and she says no, visibly disinterested. As her husband goes on about how well he did, it’s clear she’s become a master at pretending to care what he says.

Melania is much less convincing at pretending to be a normal person. In one scene that takes place within a car, Ratner asks who her favorite musical artist is. She says Michael Jackson and mentions that she loves “Billie Jean.” That is a song about a man accusing a woman of lying about having sex with her, recorded by an artist accused of abusing children. Ratner then puts the song on and joins Melania to sing the lines, “People always tell me, be careful what you do/Don’t go around breaking young girls’ hearts.”

One wonders: Do these people have any self-awareness, like at all? Perhaps the infamous Melania jacket from her husband’s first term said it best: I really don’t care, do u?

Jen Chaney is a freelance TV and film critic whose work has been published in The New York Times, TV Guide and other outlets.

The Dictatorship

Here’s how the judiciary needs to respond to Don Lemon’s arrest

ByAustin Sarat

Former BLN anchor Don Lemon was arrested and charged on Thursday with violating a federal law after being present during an anti-Immigration and Customs Enforcement (ICE) protest at a church in St. Paul, Minnesota. Since his departure from BLN in 2023, Lemon has worked independently, doing reporting and commentary on his own YouTube channel and on Substack.

Lemon and others are accused of disrupting a service at Cities Church that was being conducted by an ICE official who serves as a pastor there. Attorney General Pam Bondi described what happened as a “coordinated attack” on the church.

As she explained“Our nation was settled and founded by people fleeing religious persecution. Religious freedom is the bedrock of this country. We will protect our pastors. We will protect our churches. We will protect Americans of faith.”

In this case, the Trump administration is weaponizing its commitment to protecting religious liberty to go after Lemon and the others. The administration can dress it up any way they like. But Lemon is being targeted because he has been a long-time and vociferous critic of President Trump.

Rather than being part of the protest, Lemon was livestreaming the protests on social media. Targeting him is a signal to other journalists that they, too, may find themselves in hot water for covering and amplifying what the administration is doing in Minneapolis and other places.

Judges need to see through the ruse and stand up for press freedom at a time when the administration’s hostility to the press is reaching new heights. As Seth Stern, director of advocacy for the Freedom of the Press Foundation, put it“Lemon’s arrest under a bogus legal theory is a clear warning shot aimed at other journalists. The unmistakable message is that journalists must tread cautiously because the government is looking for any way to target them.”

Lemon is not the only journalist who has run afoul of the administration while covering protests against ICE. In 2025, 32 journalists were detained or arrestedtwenty-eight of them were at immigration-related protests.

As the U.S. Press Freedom Tracker notes“Protests have long been where the fault lines of press freedom are most visible, and 2025 was no different.” The journalists who “were pulled from news scenes, placed in cuffs and held in custody from minutes to days — long enough for deadlines to pass and breaking news to go cold…”

The Trump administration is weaponizing its commitment to protecting religious liberty to go after Lemon and the others.

In Lemon’s case, a federal magistrate judge, Douglas Micko, on Jan. 22 refused to issue arrest warrants that the government sought. Trump’s Department of Justice had tried to convince him that the warrants were necessary to allow it to respond to a “national security emergency.”

As the district court’s chief judge, Patrick Schiltz explained in a letter to the Eighth Circuit Court of Appeals, there was “no evidence” that Mr. Lemon or his producer had engaged “in any criminal behavior or conspired to do so.” The Eighth Circuit was persuaded and declined to overrule Micko’s decision.

But note, these judicial decisions did not prevent the Trump administration from arresting Lemon. Moreover, they focused more on the deficiencies in the government’s case than on providing a ringing endorsement of press freedom.

Indeed, with few exceptions, legal protections of the press are not robust.

Most cases in which courts have stood up for a free press focus either on government efforts to stop newspapers from publishing material already in their possession or punish them for material they have published.

For example, in 1964, the United States Supreme Court ruled that public figures could not win libel suits against newspapers for things they published unless they could prove “actual malice,” meaning it was published “with knowledge that it was false or with reckless disregard of whether it was false or not.”

Seven years later, the Court allowed The New York Times and the Washington Post to publish the so-called Pentagon Papers, which detailed a troubling pattern of government secrecy and deception during the Vietnam War. In that case, Justice Hugo Black wrote a stirring defense of press freedom.

“In the First Amendment,“ he observed, “The founding fathers gave the Free Press the protection it must have to fulfill its essential role in our democracy… the government’s power to censor the press was abolished so that the press could revert would remain forever free to censure the government.”

But all that meant for Black and the majority of his colleagues was that the First Amendment forbids “prior restraint.” The decision offered no protection for reporters, nor their sources.

They remain unprotected except through state shield laws. In 2005, the United States Court of Appeals for the District of Columbia made clear that the Constitution did not allow a reporter to keep the identity of an informant who leaked classified information secret. It denied that the law provided a reporter/source privilege.

The court said it could not “Seriously [entertain] the notion that the First Amendment protects a news mans agreement to conceal the criminal conduct of his source, or evidence thereof, on the theory that it is better to write about a crime than to do something about it.”

With few exceptions, legal protections of the press are not robust.

Law professors Ronnell Jones and Sonja West are right to say that “Journalists themselves have few constitutional rights when it comes to matters such as access to government sources and documents or protection from being hounded by those in power for the news gathering and reporting.” That means that they are “vulnerable to the whims of society and government officials.”

Don Lemon learned that lesson when federal authorities showed up at his door.

To keep the press free in the face of authoritarian threats, the courts must do more to protect journalists. They need to interpret the First Amendment to allow reporters to keep sources confidential, and to prohibit governmental actions that needlessly prevent journalists from carrying out their responsibilities.

They need to bolster Justice Black’s belief in the virtues of a free press by limiting the occasions on which reporters can be subject to criminal prosecution for their work.

What Thomas Jefferson said in 1787 seems especially apt today. “The basis of our government,” he wrote“being the opinion of the people, the very first object should be to keep that right; and were it left to me to decide whether we should have a government without newspapers or newspapers without a government, I should not hesitate a moment to prefer the latter.”

Only by protecting people like Don Lemon can we preserve the kind of press Jefferson envisioned and Justice Black praised.

Austin Sarat

Austin Sarat is the William Nelson Cromwell Professor of Jurisprudence and Political Science at Amherst College. The views expressed here do not represent Amherst College.

-

The Dictatorship12 months ago

The Dictatorship12 months agoLuigi Mangione acknowledges public support in first official statement since arrest

-

Politics11 months ago

Politics11 months agoFormer ‘Squad’ members launching ‘Bowman and Bush’ YouTube show

-

The Dictatorship5 months ago

The Dictatorship5 months agoMike Johnson sums up the GOP’s arrogant position on military occupation with two words

-

Politics11 months ago

Politics11 months agoBlue Light News’s Editorial Director Ryan Hutchins speaks at Blue Light News’s 2025 Governors Summit

-

The Dictatorship12 months ago

The Dictatorship12 months agoPete Hegseth’s tenure at the Pentagon goes from bad to worse

-

Politics11 months ago

Politics11 months agoFormer Kentucky AG Daniel Cameron launches Senate bid

-

Uncategorized1 year ago

Bob Good to step down as Freedom Caucus chair this week

-

Politics9 months ago

Politics9 months agoDemocrat challenging Joni Ernst: I want to ‘tear down’ party, ‘build it back up’