Congress

Ways and Means eyeing limits to corporate tax deductions

The House Ways and Means Committee is looking at limiting corporate state and local tax deductions as one way to offset the costs of a large party-line tax bill, according to two people familiar with the discussions.

The panel, which oversees all tax policy, is considering the limit among other potential offsets for the bill, according to the people, who were granted anonymity to share private deliberations. Companies currently can deduct an unlimited amount of state income, property and sales taxes from their federal tax bill.

The discussions signal that a proposal to limit corporate SALT, as the deduction is called, may have enough support among Republicans to make it into a party-line tax bill. The far-right House Freedom Caucus had previously raised the idea of putting a cap on the deduction to pay for raising the current cap on the amount of state and local taxes that individuals can deduct, but it was unclear how much buy-in the proposal had with the rest of the conference.

The discussions come as tax writers scramble to find ways to contain and offset the costs of both extending expiring tax cuts and enacting President Donald Trump’s tax priorities. House Republicans adopted a budget plan last week that set the upper limit on the size of tax cuts at $4.5 trillion, which leaves very little wiggle room for the conference to enact all of their ideas.

Extending the expiring provisions of Trump’s 2017 tax cuts for ten years would cost roughly $4 trillion without interest, according to the Congressional Budget Office. Republicans have also committed to restoring business write-offs like bonus depreciation, which would cost $378 billion over a ten-year window, according to CBO.

Those policies alone would leave little room for some of Trump’s campaign promises to eliminate income taxes on tips and overtime work, which could add hundreds of billions more in red ink.

The Ways and Means Committee has also been considering other ways to cut down the impact of a tax bill on the federal deficit. Those include strengthening work requirements for the Temporary Assistance for Needy Families program and repealing a nursing home staffing mandate implemented under the Biden administration.

According to a joint analysis by the Bipartisan Policy Center and the Tax Foundation, repealing corporate deductions for state income taxes could raise around $192 billion in revenue.

Congress

How Lindsey Graham got Trump to yes on Iran

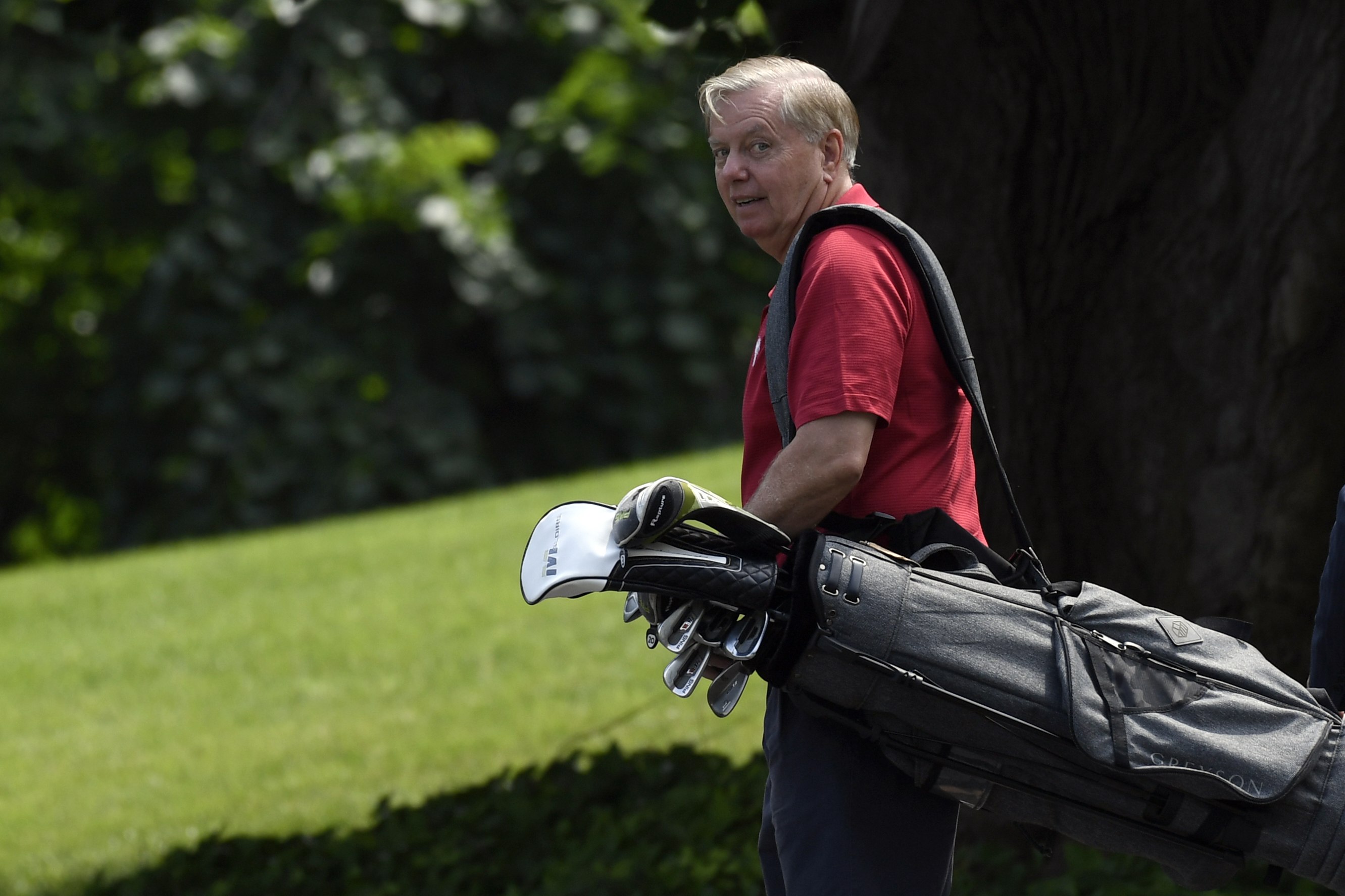

Lindsey Graham’s effort to convince Donald Trump to attack Iran began — to the surprise of no one familiar with the relationship between the South Carolina senator and the president — on the golf course.

After the 2024 election, the pair hit the links to discuss a second-term agenda for the resurgent president, and Graham had lots of advice.

In an extensive interview Tuesday in his Capitol Hill office, Graham recalled pushing Trump to “blow some shit up” to combat drug trafficking. He talked about taking on Big Tech by challenging the legal underpinnings of their industry dominance. And he counseled Trump to build on agreements he’d brokered between Israel and U.S. allies in the Middle East.

That last part, Graham emphasized, would require confronting the elephant in the region.

“We were thinking about this early, early on about how Iran is a spoiler for expanding the Abraham Accords and stability in the Mideast,” he said. “I told him before he took office … if you can collapse this terrorist regime, that’s Berlin Wall stuff.”

That launched an ongoing conversation that continued for months, culminating in a flurry of one-on-one lobbying “in the last several weeks,” Graham said. The two also talked about Iran during a Thursday White House meeting that wrapped less than 48 hours before the beginning of the vast joint U.S.-Israeli operation aimed at Iran’s missile and nuclear programs, its civilian and military leaders, as well as other key targets.

Trump’s decision to go to war was the latest indication that hawkish voices he once publicly resisted — none louder than Graham’s — have dominated his second-term decisionmaking. It was also a full-circle moment for the veteran GOP senator, who has spent decades pushing administration after administration to take military action against Iran with no success until now.

Graham’s triumph was never a given. He described a “real contest” within the administration about whether or not Trump should take military action to end a geopolitical rivalry 47 years in the making.

Another person with knowledge of the internal debate said that, within the administration, the idea of striking Iran had very few vocal backers other than U.S. Ambassador to Israel Mike Huckabee. That left Graham among those leading the charge from outside and inside.

In public, Graham used frequent cable news hits and hallway interviews in the Capitol to play up the threat posed by the Iranian nuclear and missile programs — even after Trump ordered a June strike to destroy its most sensitive nuclear facilities. He also used Trump’s preferred medium — TV hits — to lavishly praise him, frequently referring to him as “Reagan Plus” for his dramatic impact.

Privately, he appealed to Trump’s attraction to swaggering action and risk-taking over quieter moves — not to mention the term-limited president’s growing concern with his legacy.

“There was a real fight not to do it,” Graham said. “Let Israel do it by itself or just not do much. So we talked a lot about this: ‘Mr. President, you want to have your fingerprints on this. You want them to know America will fight.’”

A White House spokesperson did not respond to a request for comment Tuesday.

Graham said the successful January capture of Venezuelan leader Nicolas Maduro put Trump “in the mindset to follow through.” But he wasn’t certain until late last month when Trump sent a second aircraft carrier near the region that Trump would ultimately take action.

The strikes have opened Trump up to criticism from Democrats, key European and Middle Eastern allies and even some members of his own party, who have questioned the rationale for the sweeping operation and what the endgame will look like. Polling indicates the American public remains wary of sliding into another “forever war” in the wake of Iraq and Afghanistan.

As he makes the rounds defending Trump — both publicly to TV cameras and privately to Middle Eastern allies — Graham has tried to hammer home that the U.S. is not nation-building in Iran. Where the country goes next, he said, remains up to the Iranian people.

“If they want to reconstitute their country, to build more nuclear weapons and more missiles to hit us, we’ll treat the new people like we did the old people,” he said. “I just don’t believe it. I think they’re going to find a way to … be a different country.”

He went on to dismiss the famous “Pottery Barn rule” articulated by former Secretary of State Colin Powell before the Iraq War more than two decades ago.

“‘You break it. You own it.’ That may be true for a consignment shop, but it’s not true for foreign policy,’” Graham said. “If there’s a threat, break it.”

But Trump’s strategy has opened him up to questioning from some of his own supporters, who believe it’s a far cry from the “America First” approach he preaches. The president and some of his top advisers pledged during the 2024 campaign that his second administration wouldn’t rush into foreign entanglements. And Trump during his 2025 inauguration speech said his administration’s success would be measured in part by “the wars we never get into.”

Many of those statements have resurfaced online since this weekend’s strikes, but Trump is now singing consistently from Graham’s interventionist hymnal, and the senator said he’s not concerned Trump will back down amid the criticism and that he’s “in it to win it.”

“He’s a hard sell, but when you sell him, he’s all in,” said Graham, who argued that “America First is not ‘head in the sand.’”

The strikes have sparked a bipartisan push in Congress to block Trump from taking additional military action without congressional signoff. That effort is expected to fall short, but it inspired a lively debate during Senate Republicans’ closed-door lunch on Tuesday — and Graham was in the middle of it.

He pushed back after Sen. Todd Young (R-Ind.) criticized the lack of consultation with Congress and GOP leaders for not holding hearings, according to two people with knowledge of his comments who were granted anonymity to disclose the private moment.

While Graham’s defense of aggressive military action is nothing new, Trump’s outright embrace of it is. The idea that the pair would be working in tandem on a new Middle East war would have been unthinkable a decade ago, when Graham was running for president himself and roundly criticizing the outsider candidate’s isolationism.

As recently as 2019, Trump publicly criticized Graham’s history of advocating for military intervention in the Middle East after Graham urged him to be more aggressive after Iran bombed Saudi oil production facilities.

“It’s very easy to attack, but if you ask Lindsey, ask him how did going into the Middle East, how did that work out? And how did going into Iraq work out?” Trump said at the time.

Graham said one of his rules is to not “take yourself out of the game” just because of a past disagreement and that it paid off with a now-trusting relationship with a two-term president.

“If you had told me in 2016, I’d wind up being one of his better friends, closest adviser and admire him as commander-in-chief, I wouldn’t have believed it,” Graham said, adding that “what the president sees in me is somebody that can deliver.”

One person close to the White House, granted anonymity to speak candidly, said that if anyone had an outsize influence on Trump’s decision to attack Iran it was Graham. Sen. Rand Paul (R-Ky.), who favors a hands-off foreign policy approach, made a similar observation about Graham’s impact on Trump’s Venezuela strategy, telling reporters that his GOP colleague should be “banned from going to the White House.”

“That’s sarcasm,” Paul clarified.

Other corners of the party’s libertarian-leaning wing have been more blunt. Doug Stafford, Paul’s chief political adviser, called Graham a “warmongering fool.” And Rep. Tim Burchett (R-Tenn.) told reporters after a closed-door Iran briefing Tuesday that “Lindsey Graham hasn’t seen a fistfight he hasn’t wanted to turn into a bombing raid.”

Graham, meanwhile, is looking ahead as he back-channels with Trump and allies in the Middle East. He wants to put together a bipartisan coalition in the Senate to finish the job he talked about with Trump on the golf course — enshrining the full normalization of Israel-Arab relations with a Senate-ratified treaty.

And he is coordinating closely with Trump. The two spoke Tuesday morning, and the president has indicated he’s closely watching Graham’s TV sales pitch for the war, including declarations that the “mothership of terrorism is sinking” and the “captain is dead.”

“He called me and said … ‘I like that — stay on TV,’” he said. “Something tells me I will.”

Dasha Burns and Jack Detsch contributed to this report.

Congress

Trump met with Coinbase CEO before bashing banks over crypto bill

President Donald Trump met privately on Tuesday with Coinbase CEO Brian Armstrong before publicly backing the company’s position in an ongoing lobbying clash with banks that has derailed a major cryptocurrency bill, according to two people with knowledge of the matter who were granted anonymity to discuss a closed-door matter.

It is unclear what was discussed during the meeting, but it came just before Trump wrote on social media that banks “need to make a good deal with the Crypto Industry” in order to advance digital asset legislation that has stalled on Capitol Hill. He wrote that a recently adopted crypto law is “being threatened and undermined by the Banks, and that is unacceptable” — echoing Coinbase’s position.

A spokesperson for Coinbase declined to comment. The White House did not immediately respond to a request for comment.

The policy clash centers around whether crypto exchanges like Coinbase should be able to offer rewards programs that pay an annual percentage yield to customers who hold digital tokens known as stablecoins that are designed to maintain a value of $1. Wall Street groups are warning that allowing yield-like payments on stablecoins could lead customers to pull deposits from bank accounts and threaten lending that is critical to the economy.

Banks are pushing to ban any type of stablecoin yield payments as part of a sweeping crypto regulatory bill that is currently pending in the Senate. But a wide array of digital asset firms have fought back, and the rift helped derail the so-called crypto market structure legislation bill earlier this year. The legislation would establish new rules governing how crypto tokens are overseen by market regulators — a longtime lobbying goal for digital asset firms, which say they need “regulatory clarity” from Washington.

Coinbase, the largest U.S.-based crypto exchange, has played a key role in the spat. On the eve of a scheduled Senate Banking Committee markup in January, Armstrong came out against the most recent publicly released draft of the crypto bill. He warned in part against “Draft amendments that would kill rewards on stablecoins, allowing banks to ban their competition.” The markup was later postponed, and the bill has remained stalled ever since.

Since then, White House officials have sought to mediate a compromise between the two sides. The White House hosted a series of meetings with representatives from the banking and crypto sectors, but significant differences remain between the two sides and no deal has emerged.

Coinbase has become a major player in Trump’s Washington, thanks in part to massive political spending that is already beginning to shake up the 2026 midterm elections. The exchange, which was co-founded by Armstrong, is a leading backer of a crypto super PAC group known as Fairshake that is armed with a war chest of more than $190 million. Coinbase also donated to Trump’s inaugural committee and to the president’s White House ballroom renovation effort.

In his post on Truth Social Tuesday, Trump included a line that Armstrong has uttered verbatim in interviews about the stablecoin yield fight: “Americans should earn more money on their money.” Separately, on Tuesday night, Trump also posted a picture of an X post from Armstrong praising him for delivering “on his campaign promise to make America the crypto capital of the world.”

The crypto “Industry cannot be taken from the People of America when it is so close to becoming truly successful,” Trump wrote in the initial post.

Declan Harty contributed to this report.

Congress

Lawmakers anticipate Trump will seek emergency funding for ‘open-ended’ Iran war

Lawmakers given classified briefings Tuesday evening on the U.S. military conflict in Iran expect President Donald Trump will ask Congress for emergency cash to finance the war.

During the closed-door meetings on Capitol Hill, top Trump administration officials said only that they are considering a supplemental military funding request, according to lawmakers who attended the briefings. But senior intelligence and defense officials described a vast military operation that many members anticipate will require extra funding on top of the nearly $1 trillion Congress has already given the military over the last year.

“I think there will be a supplemental coming,” Sen. Lindsey Graham (R-S.C.) told reporters upon leaving his classified Senate briefing. “We’ll have to approve that.”

Sen. Chris Murphy of Connecticut, the top Democrat on the Senate committee overseeing funding for the Department of Homeland Security, said after the briefing that the military operation “feels like a multitrillion-dollar, open-ended conflict with a very confusing and constantly shifting set of goals” because top Trump administration officials “are refusing to take off the table ground operations.”

Sen. Josh Hawley (R-Mo.) also described the U.S.-Iran conflict as “a massive operation” that’s “rapidly changing.”

“It sounded very open-ended to me,” he added.

Some lawmakers typically opposed to increased spending are open to the idea of providing extra money to fuel the U.S. military’s operation against Iran. “I think it would have support of Republicans,” Sen. Ron Johnson (R-Wis.) said about a supplemental funding request Tuesday night.

“Everybody always wants money, any excuse, whether they’ll need it or not. My guess: They’ll need it,” Johnson continued. “We’re shooting off a lot of ammo. Gotta restock.”

But Democratic votes will be needed to pass any emergency funding package in the Senate, and minority party leaders say they will need far more details from the Trump administration if they are going to consider support for new Pentagon cash.

“Before you can feel satisfied about a supplemental — and I haven’t seen it — you have to know what the real goals are and what the endgame is,” Senate Minority Leader Chuck Schumer told reporters Tuesday.

Delaware Sen. Chris Coons, a senior Democratic appropriator, said he expects the Pentagon will send Congress a supplemental funding request and vowed to “make sure we are making all the investments we can” to keep U.S. troops safe.

But Coons said Trump administration officials need to testify at an open hearing so “the American people can get questions answered about the failures in planning that led to some of the challenges, losses and mistakes in this war.”

Any supplemental spending package to support the Iran war effort would come on top of the more than $150 billion the Pentagon got from the party-line tax and spending package Republicans enacted last summer and nearly $839 billion in regular funding Congress cleared last month.

The House’s lead Democratic appropriator, Connecticut Rep. Rosa DeLauro, said lawmakers have yet to receive information about how much the Pentagon has spent already.

“They’re talking about a supplemental, but we haven’t got a clue,” DeLauro told reporters after Trump administration officials briefed House lawmakers later Tuesday. “There’s no cost estimate of what they have spent so far. Is there anybody writing down what the hell they’re spending? No.”

Senate Majority Leader John Thune said Tuesday that Republicans “forward-funded” military operations with the party-line package enacted last summer but that lawmakers will be “paying attention” to any need for extra money.

“Not only do we have the resources to conduct the operations right now, but a lot of our allies in the region also have capabilities that are coming to bear now,” Thune said.

Even before the strikes on Iran, Trump was eyeing a massive hike in military spending for the upcoming fiscal year. He pledged to pursue a $1.5 trillion Pentagon budget, a roughly 50 percent increase to military spending.

The president said Tuesday, however, that U.S. military resources are far from depleted.

“We have a virtually unlimited supply of these weapons,” Trump said on social media. “Wars can be fought ‘forever,’ and very successfully, using just these supplies.”

Jordain Carney, Meredith Lee Hill, Connor O’Brien, Joe Gould and Calen Razor contributed to this report.

-

The Dictatorship1 year ago

The Dictatorship1 year agoLuigi Mangione acknowledges public support in first official statement since arrest

-

Politics1 year ago

Politics1 year agoFormer ‘Squad’ members launching ‘Bowman and Bush’ YouTube show

-

Politics1 year ago

Politics1 year agoBlue Light News’s Editorial Director Ryan Hutchins speaks at Blue Light News’s 2025 Governors Summit

-

The Dictatorship6 months ago

The Dictatorship6 months agoMike Johnson sums up the GOP’s arrogant position on military occupation with two words

-

Politics1 year ago

Politics1 year agoFormer Kentucky AG Daniel Cameron launches Senate bid

-

The Dictatorship1 year ago

The Dictatorship1 year agoPete Hegseth’s tenure at the Pentagon goes from bad to worse

-

Uncategorized1 year ago

Bob Good to step down as Freedom Caucus chair this week

-

Politics11 months ago

Politics11 months agoDemocrat challenging Joni Ernst: I want to ‘tear down’ party, ‘build it back up’